Can getting a good night’s sleep help to improve your overall health?

The secret to a more healthy lifestyle might be the Sleep you get. New research and guidelines demonstrate a growing understanding of how proper Sleep…

Senior Supplemental insurance policies can be an excellent option for seniors needing additional health insurance coverage beyond their Original Medicare + Medigap Coverage. These policies provide extra protection and are affordable when you turn 65. The premium amounts depend on the type of policies and coverage.

Senior Supplemental Insurance

The probability of Cancer, Heart Attack, and Stroke increases with age, but there is limited to no coverage for them with regular Medicare Insurance. Uninsured clients can incur an average of $38,500 for cardiovascular emergencies and $150,000 for Cancer.

Thankfully, there is a 90-97% chance of surviving a heart attack with timely care, but you’ll need medical care that will be expensive. Last, you don’t want to increase your stress when thinking about such potential expenses instead of enjoying your post-retirement life. The positive news is that there is a way out, and policyholders have options.

Sign up for our Senior Supplemental Insurance to get adequate coverage for your medical expenses and treatment for Cancer, Heart Attack, Stroke & Dental, Vision, and Hearing.

Why You Need Supplemental Insurance:

Supplement Insurance is intended to offer protection to policyholders and help them get back on their feet when life’s uncertainties throw a curve ball.

It will help cover your:

Additionally, we understand that you will have numerous expenses you will need to pay during this stressful time. Hence, Supplemental Insurance policies allow policyholders to use the funds as they see fit. Therefore, you won’t have to worry about financial constraints.

How Senior Supplemental Insurance helps:

Supplemental Insurance is your one-stop solution to keep your retirement secure and stress-free. Following are primary ways in which it helps you and your family:

Gives You Time to Focus on Recovery:

You cannot recover successfully if you continue worrying about your medical expenses and your disrupted savings plan. Our recommended Senior Supplemental Insurance plan can alleviate some of these financial concerns by covering all additional medical costs, allowing you to keep your savings secure to pay for a comfortable life.

The lack of anxiety will be good for your mental and physical wellness and boost your recovery.

Pays for Routine Expenses:

Recovering from Cancer, Heart Attack, or Stroke requires rest, meaning you will need someone to cover your tasks for the time being. The insurance plan is flexible, so you can use it to hire an in-home caregiver, nutritious groceries, and several routine costs.

These expenses may not be much independently, but they can accumulate and become a concern.

Keeps Your Family Out of Financial Distress:

Our recommended Supplemental Insurance plans are one of the better ways to prevent the financial burden from falling onto your family. Your kids can keep their college funds intact, and your spouse won’t need to take out loans to pay for the additional medical and healthcare costs.

Supplement Insurance plans provide the necessary coverage to ensure your loved ones can focus on your recovery 100%.

Contact Us:

We hope you have peace of mind and feel confident in your Supplemental Insurance Coverage!

If you have any questions, we would love to hear from you! You can contact us to learn more about top-rated Senior Supplemental Insurance plans in your area, get a free quote and compare your options. Please call us at 603-696-4394 or 1-833-META-T65 for a free comparison of your Supplemental Insurance Plan options.

Dental, Vision, and Hearing Insurance can help ease any worries you have about your eyesight, smile brighter and eat your favorite foods, protect the wellbeing and health of your teeth / gums, and hear the world around you better. This coverage is suitable for both short-term expenses (like annual dental or prescription glasses) and long-term expenses (like an ear or eye surgery).

Statistically, even those who lead an active and healthy life can be diagnosed with Cancer, Heart Attack, or Stroke. How would you cope with astronomical medical expenditures if you became ill with one of these deadly diseases? Cancer, Heart Attack, or Stroke Insurance lets you keep your finances healthy and allows you to concentrate on working through the illness, recover, and not worry about expenses and medical bills.

Whether an unplanned hospital admission or a scheduled one, the Hospital Indemnity Insurance Plan pays you cash for services like admission and daily stay. You can use the payout to cover medical expenditures, such as your deductible, or for necessities like food and childcare.

A Home Care insurance plan can help you manage your expenses by covering medically necessary treatments relevant to self-recovery to get you back to good health and an effective state. Home Care Insurance plans enable you to choose your home location where you engage with your healthcare providers following an unexpected accident or health concern.

How would you manage to pay your bills if an accident or illness rendered you utterly incapable of working for an extended period? A Recovery Care Insurance plan can help you manage your expenses, allowing you to choose how you want to recover and where. The payout for the treatment is sent to you directly, or you may select your approved medical provider..

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

The secret to a more healthy lifestyle might be the Sleep you get. New research and guidelines demonstrate a growing understanding of how proper Sleep…

We are working on your favorite content. Come back in a few days! Author

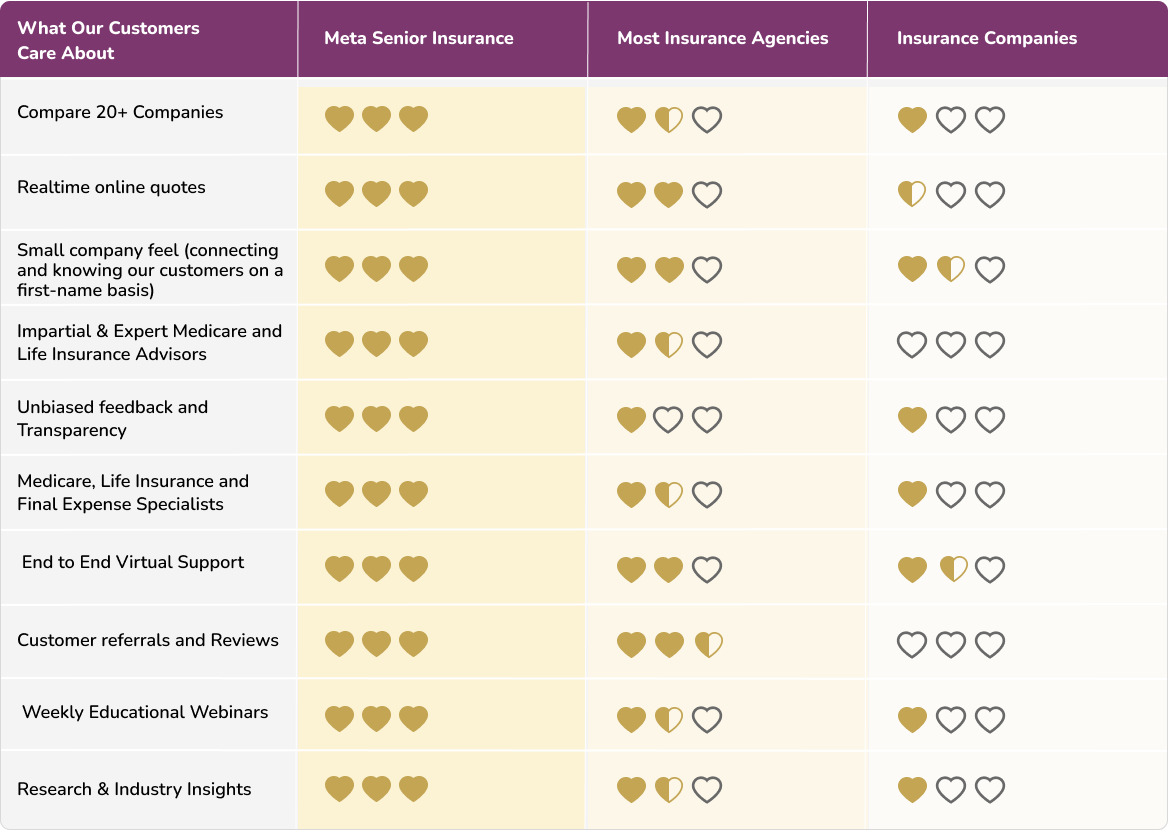

When it come to costumer service and execultion its the little guys like us who offen make the biggest waves in the industry

Our daily mantra is very simple, we will deliver mor then what our customers expected

we shared our brand cloud that make us standout in the croud

Medicare has neither reviewed nor endorsed this information. Not connected with or endorsed by the United States government or the federal Medicare program.

Copyright 2022 Meta Senior Insurance